Las Vegas, a city synonymous with bright lights and extravagant lifestyles, is often more than just a playground for tourists. Beneath the glitz and glamour lies a booming real estate market, where the quest for homeownership becomes a pivotal journey for many. Understanding mortgage rates in this vibrant city not only sheds light on the current housing landscape but also unveils the financial intricacies that come with buying a home in the heart of the Mojave Desert. As potential homeowners grapple with fluctuating interest rates and an evolving market, this article will delve into the factors influencing mortgage rates in Las Vegas, provide insights into current trends, and equip you with the knowledge to navigate this dynamic terrain. Whether you’re a first-time buyer or an experienced investor, the world of mortgage rates is waiting to be explored.

Understanding the Current Mortgage Landscape in Las Vegas

The current mortgage landscape in Las Vegas is shaped by a variety of factors that potential homebuyers and investors need to consider. With fluctuating interest rates, the local housing market is witnessing both challenges and opportunities. Some of the key aspects influencing the mortgage scene include:

- Interest Rates: Recent trends have indicated slight increases, making it essential for buyers to lock in favorable rates.

- Home Prices: Las Vegas continues to attract buyers, pushing home values upwards and affecting affordability.

- Loan Types: Conventional, FHA, and VA loans are popular among different buyer profiles, catering to varied financial needs.

Moreover, understanding the specific neighborhoods and their amenities can dramatically impact mortgage choices. Here’s a snapshot of popular areas and their average mortgage rates:

| Neighborhood | Average Home Price | Current Rate |

|---|---|---|

| Summerlin | $450,000 | 4.5% |

| Henderson | $400,000 | 4.6% |

| Las Vegas Strip | $500,000 | 4.4% |

As buyers navigate the mortgage process, staying informed about these dynamics will equip them with the knowledge to make sound financial decisions. The blend of competitive interest rates and the vibrant Las Vegas market creates a unique environment for both first-time buyers and seasoned investors.

Key Factors Impacting Mortgage Rates in the City of Lights

Numerous elements influence the mortgage rates in Las Vegas, dramatically shaping the housing market landscape. Economic indicators play a pivotal role, with changes in the national economy directly affecting the decisions of lenders. Factors such as the Federal Reserve’s interest rate movements, inflation rates, and overall job market stability all contribute to the fluctuations in mortgage rates. Additionally, local market conditions, including the supply and demand for homes, significantly impact how lenders set their rates for buyers. High demand during tourist seasons can lead to increased competition and higher rates, while off-peak times may afford buyers more favorable terms.

Another critical factor is the borrower’s financial profile. Lenders evaluate a range of attributes that can influence the offered mortgage rates. The following aspects are particularly significant:

- Credit score: Higher scores often attract lower rates and better terms.

- Down payment size: Larger down payments may lead to reduced rates.

- Loan type: Different loans (conventional, FHA, VA) come with varying risks and costs.

As these elements intertwine, they create a dynamic environment for potential homeowners looking to secure the best financing options. Below is a brief overview of how varying credit scores can affect mortgage rates:

| Credit Score Range | Typical Interest Rate |

|---|---|

| 300 – 580 | 5.5% – 7.0% |

| 581 - 670 | 4.0% – 5.5% |

| 671 – 740 | 3.0% – 4.0% |

| 741 – 850 | 2.5% – 3.0% |

Tips for Securing the Best Mortgage Rates in a Competitive Market

In today’s competitive mortgage landscape, securing the best rates requires a strategic approach. Start by shopping around—different lenders can offer significantly different rates and fees, so consulting multiple sources is crucial. Establishing a clear understanding of your credit score is also essential; higher scores often unlock lower interest rates. You might consider improving your score by paying off debts or addressing any discrepancies in your credit report before applying. Additionally, locking in rates when they are favorable can provide a cushion against potential increases in the market.

Another effective strategy is to consider various loan types and terms. While fixed-rate mortgages offer stability, variable-rate options may present lower starting rates. Explore down payment options; some programs allow for lower payments, which can influence your overall monthly costs and interest. Engaging with a knowledgeable mortgage broker can also be beneficial, as they often have access to exclusive lender rates and can help guide you through the application process. To help you visualize potential savings, refer to the following table:

| Loan Type | Average Rate (%) | Typical Term (Years) |

|---|---|---|

| Fixed-Rate | 3.5 | 30 |

| Adjustable-Rate | 3.0 | 5/1 |

| FHA Loan | 3.25 | 30 |

| VA Loan | 3.0 | 15 |

The Future of Mortgage Rates in Las Vegas: Predictions and Insights

As we look ahead, the landscape of mortgage rates in Las Vegas is poised for transformation, shaped by various economic factors. With a recovering economy and fluctuating inflation rates, predictions indicate that buyers should brace for a possible increase in rates over the next few months. Analysts suggest that key influences on these trends may include:

- Federal Reserve Policies: Adjustments in interest rates could directly impact mortgage costs.

- Local Housing Demand: Las Vegas has seen a boom in real estate, which may drive rates higher.

- Inflation Trends: Sustained inflation might push long-term rates up as lenders increase premiums to mitigate risk.

In response to these changes, potential homebuyers are encouraged to act proactively. Getting pre-approved for a mortgage could be a strategic move to lock in lower rates before potential hikes. Moreover, understanding the nuances of fixed versus adjustable-rate mortgages is essential, as each option carries different risks and benefits. For a clearer picture, consider the following table summarizing current average mortgage rates and potential future scenarios:

| Rate Type | Current Average Rate (%) | Projected Rate in 6 Months (%) |

|---|---|---|

| Fixed-Rate Mortgage | 3.75 | 4.00 |

| Adjustable-Rate Mortgage | 3.25 | 3.75 |

Q&A

Q&A: Understanding Mortgage Rates in Las Vegas

Q1: What are mortgage rates, and why do they matter?

A: Mortgage rates are the interest rates charged on a mortgage loan. They play a crucial role in determining how much you will pay for your home over time. A lower rate means you’ll pay less in interest, whereas a higher rate can significantly increase your overall costs. In Las Vegas, where the real estate market can fluctuate dramatically, understanding these rates is key to making informed financial decisions.

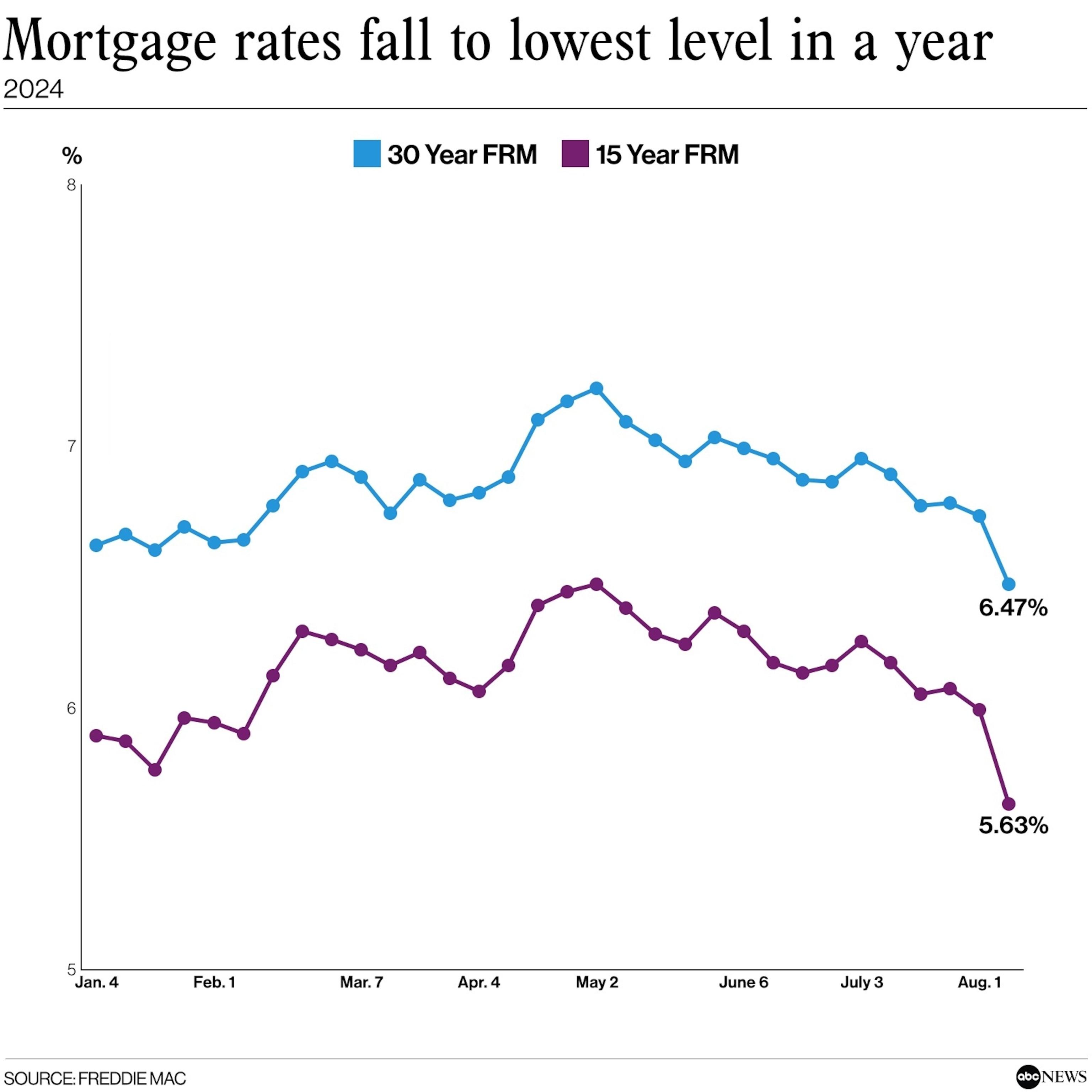

Q2: How have mortgage rates changed in Las Vegas recently?

A: Over the past few years, Las Vegas has experienced a rollercoaster ride with mortgage rates. The pandemic saw historic lows, making it an opportune time for many buyers. However, as the economy has evolved, rates have risen, reflecting adjustments by the Federal Reserve to combat inflation. Keeping an eye on these shifts is essential, especially in such a dynamic market.

Q3: What factors influence mortgage rates in Las Vegas?

A: Several elements come into play, including the national economic climate, inflation rates, and even local demand for housing. In Las Vegas, tourism and job growth can also create surges in home buying, influencing the rates. Additionally, individual factors like credit scores and loan types can significantly affect the rates one qualifies for.

Q4: What is the current trend in mortgage rates in Las Vegas?

A: As of now, mortgage rates in Las Vegas are showing signs of stabilization, though they remain slightly elevated compared to previous years. It’s important to monitor these trends regularly, as they can fluctuate based on economic indicators, industry news, and local market conditions.

Q5: How can potential buyers navigate the mortgage rate landscape in Las Vegas?

A: Potential buyers should first assess their financial health, including credit scores and debt-to-income ratios. Comparing rates from multiple lenders can often yield better deals. Additionally, staying informed about economic news can help buyers time their purchases more strategically, potentially locking in lower rates.

Q6: Are there specific mortgage programs available in Las Vegas?

A: Yes, Las Vegas offers various mortgage programs catering to different buyer needs. From conventional loans to FHA and VA loans, options abound. Many local lenders also provide first-time homebuyer programs and down payment assistance, making it easier for residents to enter the market.

Q7: What advice do experts have for potential homeowners regarding mortgage rates?

A: Experts recommend that potential homeowners be proactive. Locking in a rate when they are low can save considerable money over the life of the loan. It’s also wise to work with a knowledgeable mortgage broker who can provide insights and help find the best options based on individual circumstances.

Q8: How do I stay updated on mortgage rates in Las Vegas?

A: Staying informed is simple! You can follow local financial news, subscribe to newsletters from banks and mortgage companies, and utilize online rate comparison tools. Engaging with local real estate professionals can also provide valuable insights into current trends and forecasts.

Q9: What should buyers avoid when dealing with mortgage rates?

A: Buyers should avoid rushing into decisions without adequate research. Impulse decisions can lead to missed opportunities for better rates or terms. Additionally, it’s important to avoid overlooking the impact of the total cost of the loan; sometimes a seemingly lower rate may come with higher fees.

Q10: what should buyers consider regarding mortgage rates in Las Vegas?

A: Buyers should consider the overall economic landscape, remain adaptable to changing rates, and leverage available programs to obtain the best possible financing. Gathering knowledge and seeking expert guidance is crucial in navigating the ever-evolving mortgage landscape in Las Vegas.

Final Thoughts

As we draw the curtains on our exploration of mortgage rates in Las Vegas, it becomes clear that navigating the dynamic housing market in this glittering oasis requires both knowledge and foresight. With variables constantly at play—economic shifts, interest rate fluctuations, and industry trends—homebuyers and investors alike are encouraged to stay informed and proactive. Whether you’re looking to secure your first home among the neon lights or seeking an investment property in this ever-evolving landscape, understanding the intricacies of mortgage rates can be your guiding star. Remember, while the Vegas Strip may dazzle with its bright lights, the journey to finding the right mortgage is illuminated by careful planning and thoughtful decision-making. Here’s to making informed choices as you embark on your own unique adventure in this vibrant city!