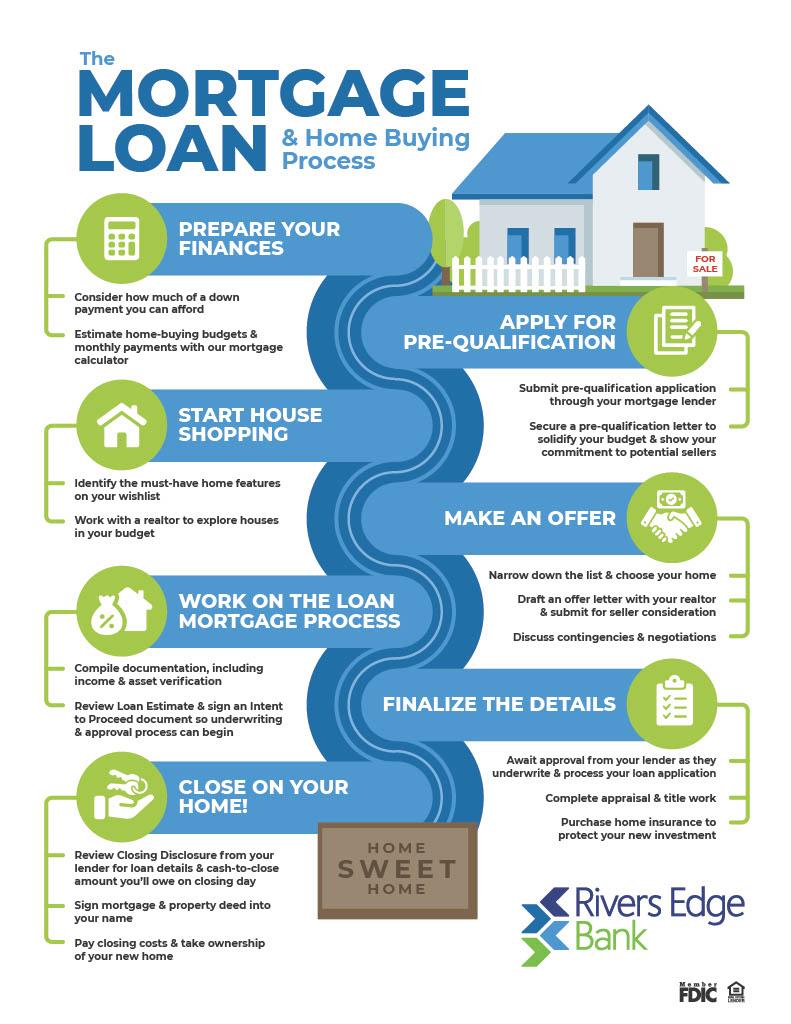

Navigating the world of home financing can often feel like a daunting journey, filled with a myriad of options and complex terminology. Whether you’re a first-time homebuyer envisioning the cozy corners of your dream abode or a seasoned investor looking to expand your real estate portfolio, understanding the various financing avenues available is crucial to making informed decisions. From traditional mortgages and government-backed loans to innovative alternative financing solutions, the landscape of home financing is as diverse as the properties themselves. In this article, we’ll explore the key options at your disposal, shedding light on their unique features, benefits, and potential pitfalls. Join us as we demystify the path to homeownership, equipping you with the knowledge to choose the financing strategy that aligns with your financial goals and lifestyle.

Understanding Traditional Mortgage Solutions

When it comes to financing a home, traditional mortgage solutions offer a wide array of options tailored to meet various financial situations and needs. A conventional fixed-rate mortgage is one of the most common choices, where the interest rate remains constant throughout the loan’s life, providing borrowers with stability and predictability. Alternatively, adjustable-rate mortgages (ARMs) begin with a lower interest rate that adjusts periodically based on market conditions, which may offer savings initially but can lead to higher payments over time. Key features of traditional mortgage solutions include:

- Loan Term Length: Typically ranging from 15 to 30 years.

- Down Payment Requirements: Usually between 3% to 20% of the home’s purchase price.

- Interest Rates: Fixed or adjustable, affecting overall borrowing costs.

Moreover, each mortgage solution comes with its unique set of qualifications and application processes, which can significantly impact the borrower’s experience. Generally, lenders assess credit scores, income stability, and debt-to-income ratios, ensuring borrowers meet their standards. Below is a simple comparison of common traditional mortgage types:

| Type | Pros | Cons |

|---|---|---|

| Fixed-Rate Mortgage | Predictable payments, long-term stability | Higher initial interest rate |

| Adjustable-Rate Mortgage | Lower initial payments, potential for lower rates | Payments can increase significantly |

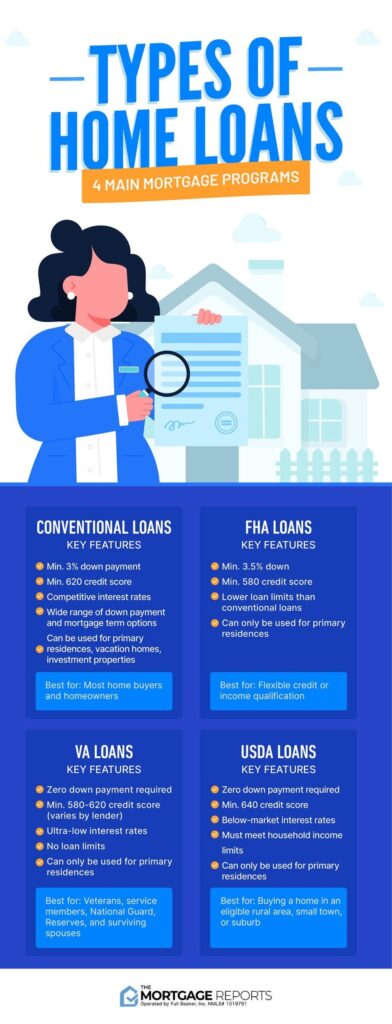

Exploring Government-Backed Loan Programs

The landscape of home financing is rich with opportunities, particularly when it comes to government-backed loan programs. These initiatives are designed to help a diverse range of buyers, from first-time homeowners to those with less-than-perfect credit scores. Some of the most notable programs include:

- FHA Loans: Insured by the Federal Housing Administration, these loans require lower down payments and are ideal for those with lower credit scores.

- VA Loans: Available to veterans and active-duty military personnel, these loans offer favorable terms and do not require a down payment.

- USDA Loans: Targeting rural and suburban homebuyers, these loans support low to moderate-income purchasers with zero down payment options.

Exploring these options can yield significant financial benefits. Not only do government-backed loans often come with lower interest rates, but they also provide flexibility in qualifying criteria. To give you a clearer picture, here’s a quick comparison of key aspects:

| Loan Type | Down Payment | Credit Score Requirement | Mortgage Insurance |

|---|---|---|---|

| FHA | 3.5% | 580+ | Yes |

| VA | 0% | No minimum | No |

| USDA | 0% | 640+ | Yes |

The Rise of Alternative Financing Methods

The landscape of home financing is evolving as traditional banking methods give way to innovative solutions that cater to a diverse range of needs. Homebuyers, especially millennials and Gen Z, are increasingly seeking flexibility and accessibility in their financing options, pushing lenders to think outside the box. Emergent methods such as peer-to-peer lending and crowdfunding are gaining traction, creating opportunities for individuals to invest in real estate or secure loans without the constraints of conventional financial institutions.

Among the noteworthy alternative options, buyers are finding value in:

- Co-ownership arrangements: Sharing property ownership reduces the financial burden and opens doors for first-time buyers.

- Rent-to-own schemes: These allow renters to gradually transition into homeowners by applying rental payments toward their eventual purchase.

- Blockchain-based financing: This technology streamlines the loan process while enhancing transparency and security.

| Alternative Method | Description | Benefits |

|---|---|---|

| Peer-to-Peer Lending | Direct loans between individuals without intermediaries. | Lower interest rates, faster approval times. |

| Crowdfunding | Gathering funds from multiple contributors for property purchase. | Access to a larger pool of investors, democratizing real estate investment. |

| Co-ownership | Shared ownership among multiple parties. | Lower individual investment, shared responsibilities. |

Maximizing Your Home Financing Strategy

When navigating the world of home financing, it’s essential to explore various options that align with your financial goals and circumstances. Consider the following strategies to enhance your financing experience:

- Fixed-Rate Mortgages: Provide stability in monthly payments, ideal for long-term budgeting.

- Adjustable-Rate Mortgages (ARMs): Lower initial rates can be advantageous if you plan to move or refinance within a few years.

- FHA Loans: Perfect for first-time buyers, offering lower down payment requirements and more flexible credit criteria.

- VA Loans: Available for veterans and active-duty service members, these loans offer zero down payment options.

In addition to conventional loans, exploring alternative financing options may also yield significant advantages. Evaluate the potential of home equity loans or lines of credit to leverage the equity accumulated in your home for renovations or investments. For a more comprehensive understanding, here’s a simple comparison of these financing options:

| Option | Best For | Down Payment | Interest Rate |

|---|---|---|---|

| Fixed-Rate Mortgage | Long-term stability | Varies | Stable |

| Adjustable-Rate Mortgage | Short-term needs | Varies | Variable |

| FHA Loan | First-time buyers | As low as 3.5% | Competitive |

| VA Loan | Veterans | 0% | Low |

Q&A

Q&A: Navigating Home Financing Options

Q1: What are the most common home financing options available to buyers?

A1: When it comes to financing a home, buyers typically encounter several popular options. The most common include conventional loans, which are not insured by the government; Federal Housing Administration (FHA) loans, which are designed for low-to-moderate-income buyers with lower credit scores; and Veterans Affairs (VA) loans, benefiting eligible veterans with favorable terms. Additionally, there are USDA loans aimed at rural property buyers and adjustable-rate mortgages (ARMs) that can offer lower initial rates.

Q2: How do I determine which financing option is best for me?

A2: Choosing the right financing option depends on your financial situation, credit score, and homeownership goals. Consider factors like your down payment capacity, how long you plan to stay in the home, and monthly budget constraints. It’s wise to compare loan terms, interest rates, and fees, as well as to consult with a financial advisor or mortgage broker, who can provide personalized recommendations based on your circumstances.

Q3: What role does my credit score play in securing a home loan?

A3: Your credit score is a crucial element in the home financing process. Lenders use it to assess your creditworthiness and determine the interest rate and terms of your loan. A higher score can lead to lower rates and better conditions, while a lower score may limit your options or result in higher costs. It’s advisable to review your credit report and improve your score, if necessary, before applying for financing.

Q4: Are there specific government programs that can assist first-time homebuyers?

A4: Yes, several government programs cater specifically to first-time homebuyers. FHA loans offer low down payment options, while the VA and USDA loans provide specific benefits for qualified buyers in rural areas and veterans, respectively. Additionally, many states and municipalities have Down Payment Assistance (DPA) programs that can help cover upfront costs. Researching available local options is key to maximizing your financing potential.

Q5: What should I know about down payments?

A5: Down payments are an essential part of most home financing deals, typically ranging from 3% to 20% of the home’s price. While conventional loans often require 20% to avoid private mortgage insurance (PMI), FHA loans allow for lower down payments, and VA loans can be obtained with no down payment at all. Consider your financial situation and long-term goals when deciding how much to put down; a larger down payment can result in lower monthly payments and less interest paid over time.

Q6: Can I refinance my mortgage later on?

A6: Absolutely! Refinancing your mortgage is an option many homeowners consider as their financial circumstances change or market conditions evolve. Whether you are looking for a lower interest rate, reducing your loan term, or accessing home equity for additional expenses, refinancing can help you achieve greater flexibility. However, it’s important to weigh the costs of refinancing against the benefits to ensure it serves your best interests.

Q7: What are the potential pitfalls to watch out for when financing a home?

A7: Some common pitfalls include failing to read the fine print of loan agreements, overlooking additional fees (like closing costs or PMI), and not comparing multiple offers from different lenders. It’s also vital to avoid borrowing more than you can comfortably repay, as this could lead to financial strain. Conduct thorough research and maintain open communication with lenders to navigate the home financing process smoothly.

This Q&A is designed to shed light on the complexities of home financing options and help prospective buyers make informed decisions on their journey toward homeownership.

Closing Remarks

As you embark on the journey of home financing, it’s essential to remember that every path is unique—much like the home you dream of creating. With an array of options at your fingertips, from traditional mortgages to innovative financing solutions, the right choice is one that aligns with your financial landscape and personal aspirations. Whether you’re a first-time buyer or looking to refinance, take the time to explore, ask questions, and weigh the pros and cons of each alternative.

securing home financing is not just about numbers; it’s about building a foundation for your future. So, as you sift through the various options available, envision the life you want to cultivate within those walls. By making informed decisions today, you’re not only investing in a property—you’re nurturing the spaces where memories will be made, laughter will echo, and life will unfold. With patience and diligence, your dream home is well within reach. Happy house hunting!