As the neon lights of Las Vegas shimmer against a desert backdrop, the city is known not only for its entertainment and allure but also for its dynamic real estate market. Amid the bustling Strip and serene suburbs, a critical force silently dictates the ebb and flow of home sales: interest rates. In a landscape where housing dreams can rise as quickly as a jackpot win, understanding how fluctuations in interest rates influence buyer behavior and market trends becomes essential. This article delves into the intricate relationship between interest rates and Las Vegas home sales, illuminating how these financial adjustments shape the decisions of both buyers and sellers in this vibrant market. Whether you’re a prospective homeowner, a seasoned investor, or simply curious about the mechanics of real estate, join us as we explore the multifaceted impact of interest rate movements on the ever-evolving Las Vegas housing landscape.

Understanding the Relationship Between Interest Rates and Housing Demand in Las Vegas

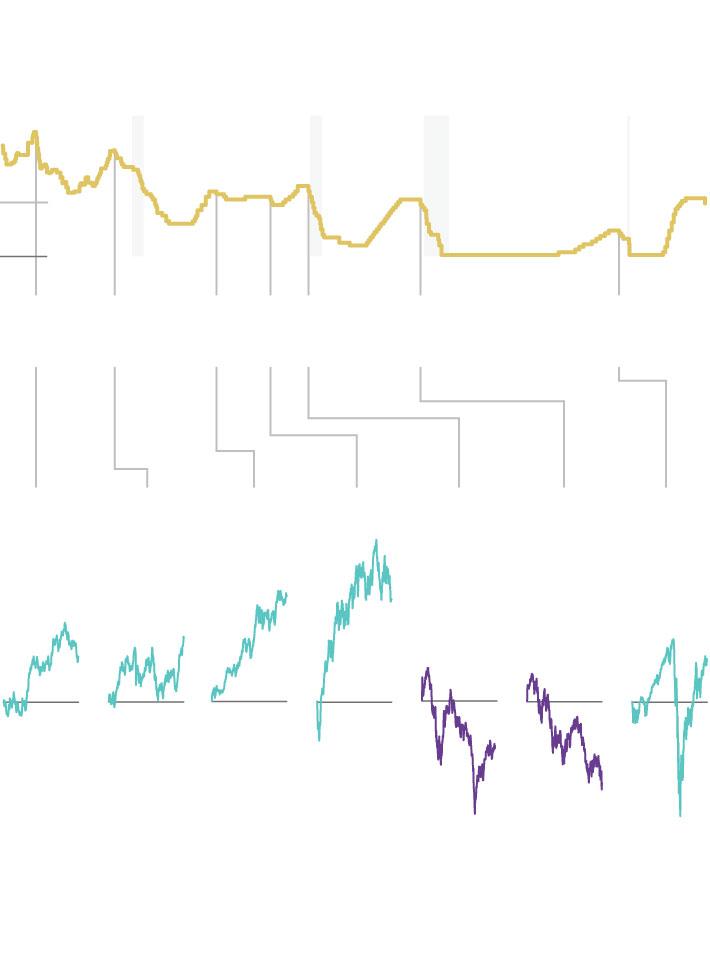

Interest rates play a pivotal role in shaping housing demand, particularly in rapidly growing markets like Las Vegas. When interest rates rise, the cost of borrowing increases, which can lead to a decrease in homebuyer affordability. As a result, potential buyers may postpone their home purchases or opt for less expensive properties. Conversely, when interest rates decrease, homes become more affordable, encouraging buyers to enter the market. This dynamic creates a direct correlation between the fluctuations in interest rates and the overall demand for housing, with Las Vegas often experiencing significant shifts reflective of these changes.

Several factors contribute to the unique relationship between interest rates and housing demand in the Las Vegas area:

- Local Economy: A healthy job market can offset the impact of high interest rates, as more individuals can still afford to buy despite increased borrowing costs.

- Investor Activity: Las Vegas attracts a number of real estate investors; shifts in interest rates can influence their purchasing strategies.

- Market Sentiment: Consumer confidence plays a crucial role; lower interest rates often boost sentiment, driving demand, while higher rates may create uncertainty.

To illustrate the influence of interest rates on housing demand in Las Vegas, consider the following data:

| Interest Rate (%) | Median Home Price ($) | Sales Volume (Units) |

|---|---|---|

| 3.0 | 350,000 | 1,200 |

| 4.5 | 380,000 | 1,000 |

| 5.5 | 400,000 | 750 |

This table highlights how an increase in interest rates often aligns with a rise in median home prices but accompanies a notable decline in sales volume. Such trends underscore the complex interplay between economic factors and consumer behavior in a city known for its fluctuating real estate landscape.

The Impact of Rising Borrowing Costs on Home Buyer Behavior

The landscape of home buying in Las Vegas is intricately linked to borrowing costs, which have seen a significant uptick in recent months. This shift has inevitably influenced potential buyers’ decisions and changed the dynamics of the real estate market. Higher interest rates mean increased monthly mortgage payments, making homeownership less affordable for many. Consequently, potential buyers are now forced to reevaluate their budgets, leading to a surge in demand for more modestly priced homes. As financial feasibility becomes a priority, first-time buyers may feel particularly squeezed, often opting to wait on the sidelines rather than risk overextending their finances.

Market trends reveal a noticeable behavioral shift among buyers as they adapt to these new economic realities. Many are prioritizing lower price points, shifting interest toward previously overlooked neighborhoods that may offer better value. Additionally, some prospective homeowners are considering adjustable-rate mortgages (ARMs) as a strategy to mitigate the pain of higher fixed rates, aiming for more manageable initial payments. These tactics, while resourceful, highlight the direct correlation between borrowing costs and buyer psychology; as rates rise, so does the importance of flexibility and affordability in the decision-making process.

Navigating the Market: Strategies for Buyers and Sellers Amid Fluctuating Interest Rates

The current landscape of fluctuating interest rates presents unique challenges and opportunities for both buyers and sellers in the Las Vegas housing market. Buyers, facing rising interest rates, need to adopt a strategic approach to secure favorable mortgage terms. Some effective strategies include:

- Locking in rates early: Consider locking in a mortgage rate when they’re low to avoid future rate hikes.

- Exploring adjustable-rate mortgages (ARMs): Initial lower rates can be beneficial for those planning to move or refinance in the near future.

- Negotiating seller concessions: Propose terms that could have sellers cover closing costs to offset higher monthly payments.

For sellers, navigating a market with rising rates doesn’t mean that demand has evaporated. Instead, crafting a compelling strategy can help attract buyers even in uncertain times. Key tactics include:

- Offering competitive pricing: Analyze recent sales to price homes attractively and draw interest despite rising rates.

- Highlighting home features: Emphasize energy efficiency and other cost-saving attributes that make a home financially appealing.

- Flexible closing terms: Providing potential buyers with flexible closing or financing options can make an offer more attractive.

| Strategy | Target Audience | Benefit |

|---|---|---|

| Locking in rates early | Buyers | Prevents loss from future interest rate increases |

| Competitive pricing | Sellers | Attracts buyers easily in a fluctuating market |

| Listing unique property features | Sellers | Differentiates the property from others on the market |

| Negotiating seller concessions | Buyers | Helps offset high monthly payments due to interest |

Future Outlook: Preparing for Potential Changes in Las Vegas Home Sales Dynamics

As we look ahead, several factors are likely to influence the dynamics of home sales in Las Vegas. The fluctuating interest rates remain a primary concern, directly impacting purchasing power for potential buyers. This could lead to shifts in demand, requiring sellers to adapt their strategies. Key considerations for homeowners and investors include:

- Market Readiness: Keeping a close eye on interest rate trends and being prepared to adjust pricing strategies accordingly.

- Buyer Affordability: Understanding how rising rates may squeeze buyers’ budgets, prompting a reevaluation of property listings.

- Financing Options: Exploring creative financing solutions, such as seller concessions or adjustable-rate mortgages, to attract prospective buyers.

Additionally, external economic factors can further complicate the landscape. A potential recession or changes in employment rates could affect buyer sentiment and decrease overall activity in the housing market. Home sellers may need to focus on enhancing their property’s appeal to mitigate these effects. Considerations include:

- Home Improvements: Investing in renovations that yield high returns, ensuring homes stand out in a competitive market.

- Marketing Techniques: Leveraging digital marketing and virtual tours to reach a wider audience.

- Flexibility in Negotiations: Being open to price negotiations can facilitate quicker sales in uncertain times.

Q&A

Q&A: How Interest Rates Affect Las Vegas Home Sales

Q: How do interest rates influence home sales in Las Vegas?

A: Interest rates are a key factor in the housing market, impacting affordability for buyers. When rates are low, borrowing costs decrease, making it easier for buyers to secure loans and ultimately purchase homes. Conversely, when interest rates rise, monthly mortgage payments increase, which can deter prospective buyers and slow down sales.

Q: What specific trends have been observed in Las Vegas as interest rates fluctuate?

A: In a city known for its rapid growth, Las Vegas has experienced varying trends. When interest rates were historically low, we saw a surge in home sales and increased competition among buyers. However, as rates rose in recent years, there was a noticeable dip in sales, with longer times on the market for listings and more leverage for buyers seeking to negotiate prices.

Q: Are there particular types of homes in Las Vegas that are more impacted by interest rate changes?

A: Yes, generally, first-time homebuyers and entry-level homes are more sensitive to changes in interest rates. These buyers often operate within tighter budgets, so small shifts in interest rates can significantly affect their purchasing power. Luxury homes may see less impact, as buyers in that market are often less reliant on financing.

Q: What strategies can buyers implement in a fluctuating interest rate environment?

A: Buyers can explore fixed-rate mortgages, which lock in a lower rate for the long term, or consider an adjustable-rate mortgage (ARM), which may offer lower initial rates. Additionally, timing their purchase during periods of lower rates or negotiating seller concessions to offset higher costs can be beneficial strategies.

Q: How do rising interest rates affect home prices in Las Vegas?

A: Rising interest rates typically lead to decreased demand, as higher borrowing costs push some potential buyers out of the market. With lowered demand, home prices may stabilize or even decline. However, given Las Vegas’s unique market with its influx of new residents and investors, dynamics can vary, sometimes resulting in less pronounced price adjustments.

Q: What should sellers keep in mind regarding interest rates when listing their homes?

A: Sellers should be aware that high interest rates may reduce the pool of potential buyers. To attract attention, they might consider pricing their homes competitively or offering incentives, such as assistance with closing costs or home warranties. Understanding local market conditions and consumer sentiment during high-rate periods can also inform better sales strategies.

Q: How can potential buyers stay informed about interest rate changes?

A: Buyers can follow financial news, subscribe to economic reports, and consult with mortgage brokers or real estate agents for expert insights. Online mortgage calculators can help assess how current rates will impact monthly payments and overall affordability, allowing buyers to make informed decisions.

Q: What’s the overall outlook for Las Vegas home sales in relation to interest rates?

A: While interest rates play a significant role in shaping the housing market, Las Vegas is influenced by many factors, including population growth, the job market, and local economic conditions. Even if interest rates rise, the allure of Las Vegas—its lifestyle, entertainment, and job opportunities—could continue to sustain demand and support home sales, albeit under different dynamics.

The Conclusion

As we draw the curtain on our exploration of how interest rates shape the Las Vegas home sales landscape, it’s clear that the intricate dance between borrowing costs and market dynamics continues to influence buyers and sellers alike. While rates may rise and fall in a rhythm dictated by economic forces, their impact echoes through the bustling streets of this vibrant city. Whether you’re a prospective homeowner dreaming of neon-lit nights or an investor examining the shifting sands of real estate, understanding these financial tides is essential for making informed decisions. As we look ahead, one thing remains certain: in the world of Las Vegas real estate, every interest rate change tells a story, and the best is yet to come for those willing to navigate this ever-evolving market.